ASSURANCE

We are committed to ensuring that the projects we finance are socially and environmentally sustainable, designed and carried out with the principles of good governance and due diligence, and compliant with both relevant laws and international best practice.

THE BANK’S POLICIES

All projects are appraised against the Bank’s Environmental and Social Policy and Performance Requirements. The form and extent of the appraisal depends on the project’s size, location and potential environmental and social impacts. But what happens when a project isn’t fully compliant? In such cases, the EBRD will agree an Environmental and Social Action Plan with the client to bring the project up to the required standards within a reasonable timeframe.

Where it is anticipated that a project will not fully meet the Performance Requirement in a reasonable timeframe – typically because of affordability constraints – but there are compensating environmental or social benefits, the EBRD’s Board may approve derogations from specific parts of the performance requirements. Any approved derogations are detailed in this report here.

Read more

- Operational results in 2015

- Disclosure of Category A projects

- Environmental Sustainability Bonds

- Derogations

- Measuring and monitoring performance

- Financial intermediaries

- Occupational health and safety

- Project Complaint Mechanism

OPERATIONAL RESULTS IN 2015

The environmental and social category – A, B, C or FI (Financial Intermediary) – reflects the potential impacts associated with a project and determines the nature of the environmental and social appraisal, information disclosure and stakeholder engagement required.

Category A projects: are projects with potentially significant and diverse environmental and social impacts, requiring a detailed participatory assessment process.

Category B projects: projects with environmental and social impacts that are site-specific and which can be readily assessed and managed.

Category C projects: projects that are expected to result in minimal adverse environmental or social impacts.

Category FI projects: transactions that involve the provision of financing to a financial intermediary – typically a bank or a fund – which are required to adopt and implement procedures to manage their environmental and social risks.

Breakdown of annual Bank investment by category

| Environmental and social category |

€ million | % by volume | No. of projects | % by no. of projects |

|---|---|---|---|---|

| Category A | 1,597 | 20.5 | 14 | 4.2 |

| Category B | 3,774 | 48.4 | 178 | 53.9 |

| Category C | 206 | 2.6 | 10 | 3.0 |

| Category FI | 2,222 | 28.5 | 128 | 38.8 |

MEASURING AND MONITORING PERFORMANCE

Throughout the investment cycle, the environmental and social performance of all EBRD projects is closely monitored. This monitoring involves a combination of client reporting, regular site visits by Bank staff and independent audits.

We conducted environmental and social monitoring visits to 84 projects in 2015.

As part of our monitoring, we require each of our clients to provide us with a report, at least annually, on their environmental and social performance and the implementation of applicable Environmental and Social Action Plans (ESAPs). Across our portfolio, 94 per cent of projects have fulfilled this environmental and social reporting requirement over the last two years.

A lack of environmental and social reporting by a client is usually a signal to the Bank that they need assistance in this regard, so our Environment and Sustainability department steps in with enhanced monitoring, which usually leads to more frequent site visits or assistance with capacity-building initiatives.

At the start of 2015 our project portfolio included 80 active Category A projects. Based on monitoring and supervision during the year, we consider that 73 (91 per cent) of these projects are meeting or exceeding our Environmental and Social Policy and Performance Requirements. Six projects have issues that need to be addressed and their overall compliance with the Performance Requirements is rated as “marginal”. This year only one project is considered to have a “poor” overall compliance rating. Where projects are found to be falling below the environmental and social standards that have been agreed with clients, we provide enhanced supervision and assistance. Where this poor performance persists, the Banks may consider alternative responses, such as halting future disbursements, until improvements are implemented.

Introducing performance indicators

To coincide with the adoption of the revised Environmental and Social Policy in November 2014, the EBRD has introduced a system of performance indicators for new direct investment projects. This system will monitor implementation of the Bank’s Performance Requirements over time. The objectives of this work are:

- more accountability: providing quantified data and enhanced assurance for the Bank’s other stakeholders on how the Bank is implementing its Environmental and Social Policy

- improved management of resources: allowing EBRD management to analyse trends and identify issues or sectors that require additional resources. This will inform departmental planning, training, recruitment and use of technical cooperation funds

- enhanced reporting: the outputs will be included in future editions of the Sustainability Report and will give a detailed assessment of the environmental and social performance of EBRD projects.

As this is the first year of the system, the Bank is currently collecting baseline data and developing reporting metrics. The table shows the percentage of the 113 projects that so far have been subject to this new system and that have triggered each of the Performance Requirements.

| Performance Requirement* | % of projects |

|---|---|

| PR1: Environmental and Social Assessment and Management | 98 |

| PR2: Labour | 98 |

| PR3: Resource Efficiency and Pollution Control | 96 |

| PR4: Health and Safety | 98 |

| PR5: Land Acquisition and Involuntary Resettlement | 28 |

| PR6: Biodiversity | 42 |

| PR7: Indigenous People | 0 |

| PR8: Cultural Heritage | 27 |

| PR10: Stakeholder Engagement | 93 |

* PR9 applies only to investments made through financial intermediaries. These are monitored separately, via the FI Sustainability Index.

DISCLOSURE OF CATEGORY A PROJECTS

- A total of 16 new Category A projects requiring an Environmental and Social Impact Assessment (ESIA) were in an active disclosure period during 2015.

- Twelve of the projects proceeded to the EBRD’s Board of Directors for review and approval; four projects have not yet been scheduled for Board consideration.

- Of the projects proceeding to the Board of Directors, all projects met the disclosure requirement of 60 days minimum for private sector projects, or 120 days minimum for public sector projects before Board review.

Full ESIAs for all 16 projects were available in local languages and were disclosed electronically. Links were provided to each project’s ESIA page on our website. Since 7 November 2014, all new ESIAs have been disclosed directly on our website in addition to the client’s website.

In 2015 no requests were made by an institution to review ESIAs in our offices in London.

Summary of Category A disclosure/Board review in 2015

As of 31 December 2015, projects marked * had not yet been submitted to the EBRD’s Board for approval

| Country | Project number | Project name | Sector | Date ESIA on EBRD website and in RO | Board date | Days available (before Board) | Language of ESIA |

|---|---|---|---|---|---|---|---|

| Turkey | 44596 | EFELER GPP | Private | 23/09/14 | 06/05/15 | 226 | Turkish and English |

| Poland | 46962 | Polenerga Wind Farm portfolio | Private | 15/10/14 | 25/02/15 | 134 | Polish and English |

| Kazakhstan | 46788 | Project Koktaszhal | Private | 14/11/14 | 11/02/15 | 90 | Kazakh and some Russian and English |

| Bulgaria | 44080 | Krumovgrad Gold Mine Project | Private | 09/12/14 | 21/4/15 | 134 | Bulgarian and English |

| Serbia | 43764 | Dolovo Cibuk I Wind Farm* | Private | 06/02/15 | N/A | – | Serbian and English |

| Morocco | 47006 | Nador West Med Port Project | Public | 18/03/15 | 22/07/15 | 127 | Arabic and French |

| Serbia | 46892 | Alibunar A Windfarm Project* | Private | 13/05/15 | N/A | – | Serbian and English |

| Poland | 47247 | Volkswagen in Wrzesnia | Private | 19/05/15 | 22/07/15 | 65 | Polish and German |

| Azerbaijan | 46766 | Lukoil Shah Deniz Stage II | Private | 21/05/15 | 22/07/15 | 63 | Azeri and English |

| Armenia | 46172 | Yerevan Solid Waste Project | Public | 24/06/15 | 28/10/15 | 127 | Armenian and English |

| Kazakhstan | 47229 | Kurty Buribaytal Road Project | Public | 25/06/15 | 09/12/15 | 168 | Russian, Kazakh, English |

| Egypt | 47336 | Damanhour CCGT | Public | 13/07/15 | 11/11/15 | 122 | Arabic and English |

| Morocco | 47297 | Khalladi Wind Farm | Private | 14/08/15 | 14/10/15 | 62 | Arabic and French |

| Turkey | 47081 | Gama Enerji Equity* | Private | 15/08/15 | N/A | – | Turkish and English |

| FYR Macedonia | 46274 | 400 kV Transmission Line SS Bitola-Macedonian/Albanian border | Public | 23/07/15 | 25/11/15 | 126 | Macedonian and English |

| Slovak Republic | 47107 | D4 Highway/R7 Expressway* | Private | 06/11/15 | N/A | – | Slovak and English |

ENVIRONMENTAL SUSTAINABILITY BONDS

We established the Environmental Sustainability Bond Programme (ESBP) in response to clear investor demand for this type of bond product. The projects financed by the ESBP achieve specific environmental benefits and, collectively, comprise our Green Project Portfolio (GPP).

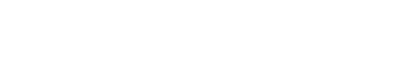

The ESBP enables the Bank to broaden its sources of funding. Since 2010 we have issued 39 bonds under the programme for a total of €787 million.

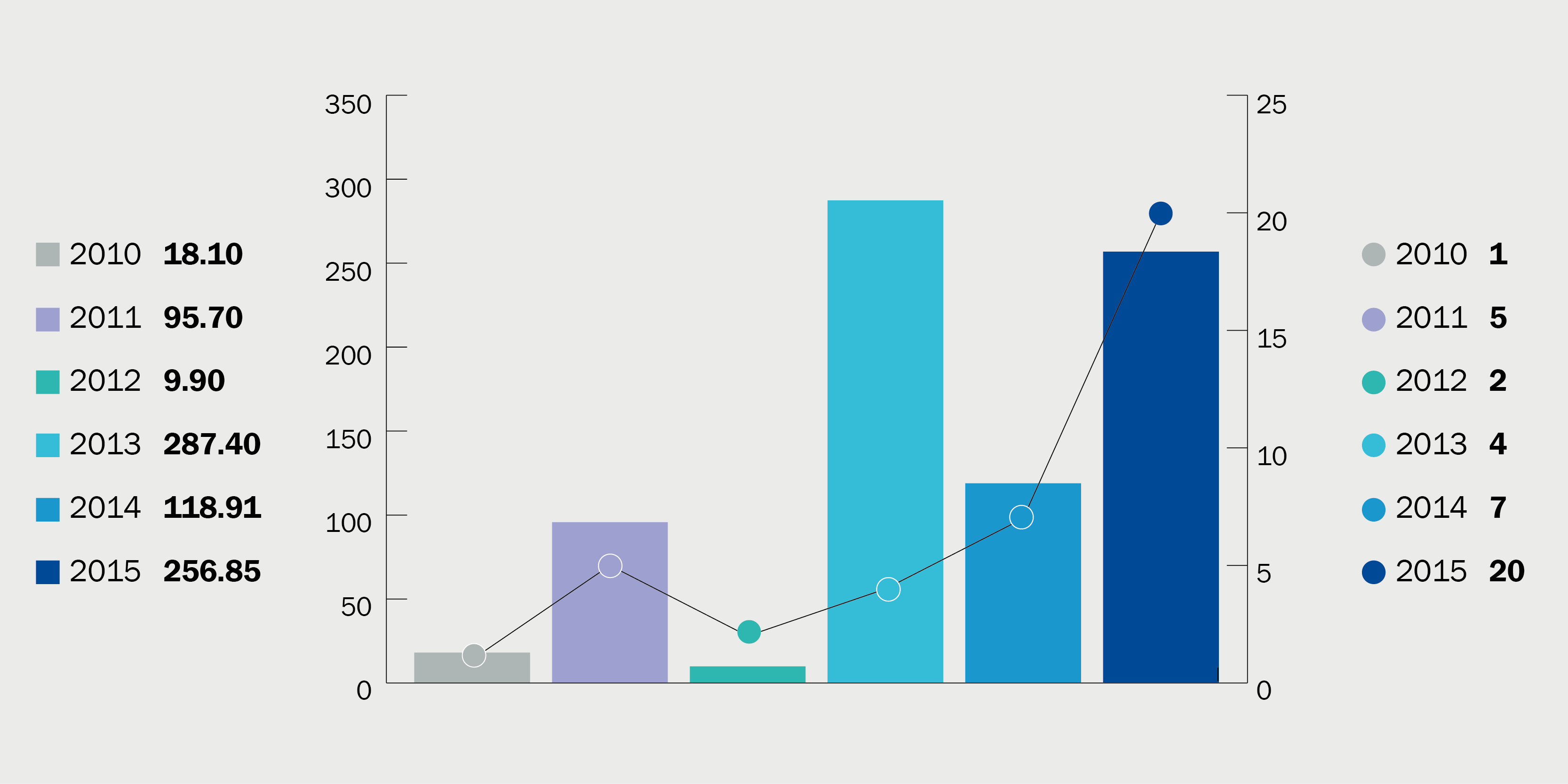

In 2015 we issued 20 Environmental Sustainability Bonds, denominated in Brazilian real, Indian rupee, Indonesian rupiah, Russian rouble and Turkish lira. Investors also have the opportunity to invest in our other bonds. Total issuance of green bonds in 2015 amounted to €257 million.

Not only do green bond issues attract a new investor base but they allow us to highlight the importance placed by the EBRD on environmentally sound and sustainable development to a wider audience while fulfilling core elements of our mandate.

Many socially responsible investors also purchase our generic bonds. Total medium- to long-term issuance in 2015 amounted to €4.2 billion.

Chart 1: Bond issues by year

Chart 2: Issued currencies since inception

GREEN PROJECT PORTFOLIO

Our Environmental Sustainability Bond Programme is directly linked to the disbursed amount of the Green Project Portfolio (GPP). This is a replenishing portfolio with strict eligibility criteria (see below) that ensures that the proceeds of our Green Bonds are immediately directed towards projects with positive environmental impacts.

As at 31 December 2015, the GPP comprised 341 loans across 31 countries, totalling €5.73 billion of which €3.65 billion was drawn down.

The weighted-average age (from the point of signing to 2015 year-end) of the GPP is 2.6 years, and of the €3.65 billion drawn-down amount, 43 per cent of the underlying projects are in a disbursement phase with the remaining 57 per cent being in a repayment phase.

The average tenor of the projects was 9.7 years and the average remaining life was 7.5 years. The EBRD limits the total amount of Environmental Sustainability Bonds to no more than 70 per cent of the drawn-down amount of the GPP. This limit ensures that all of the proceeds of these bonds are directed towards supporting our GPP.

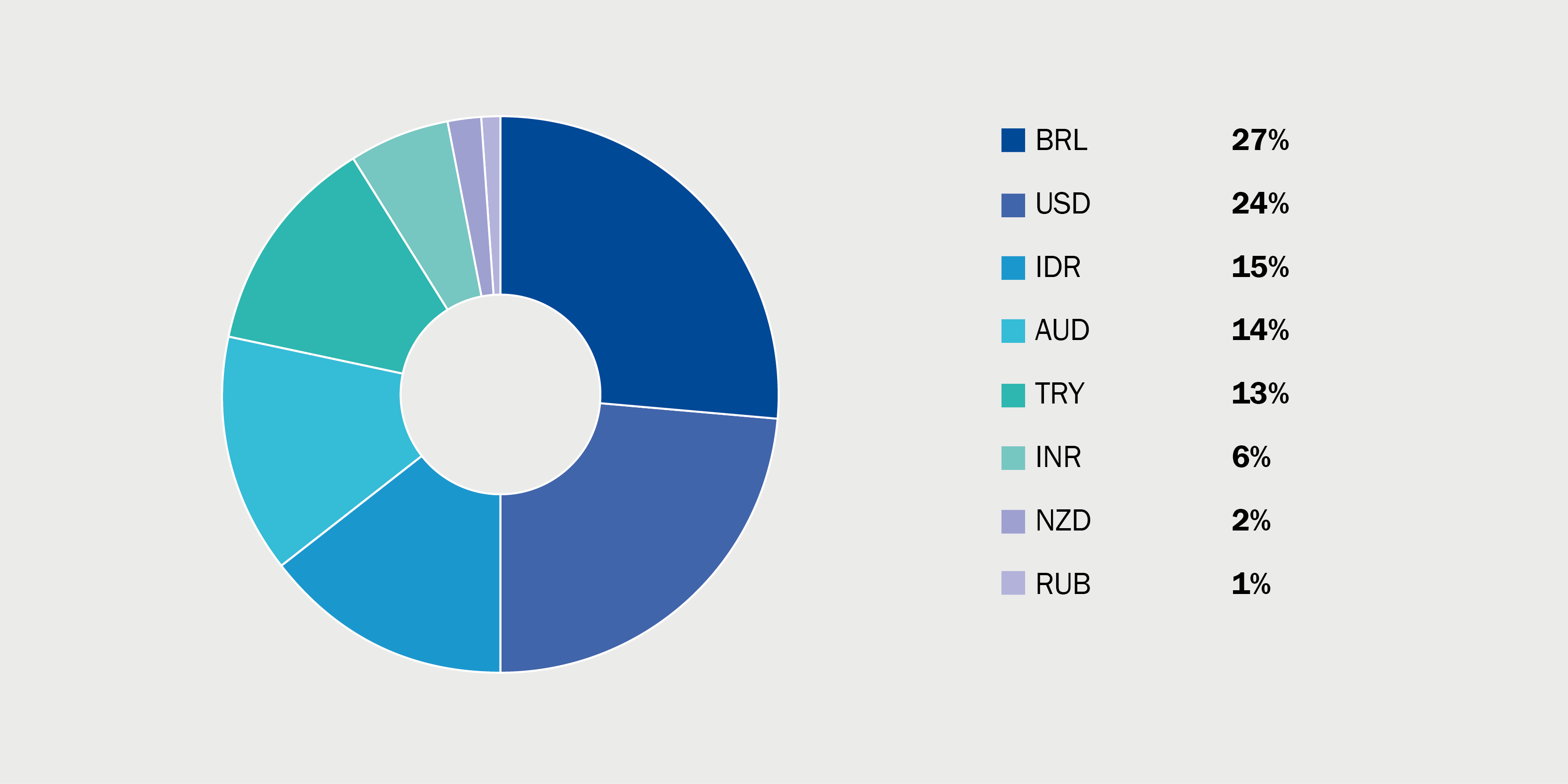

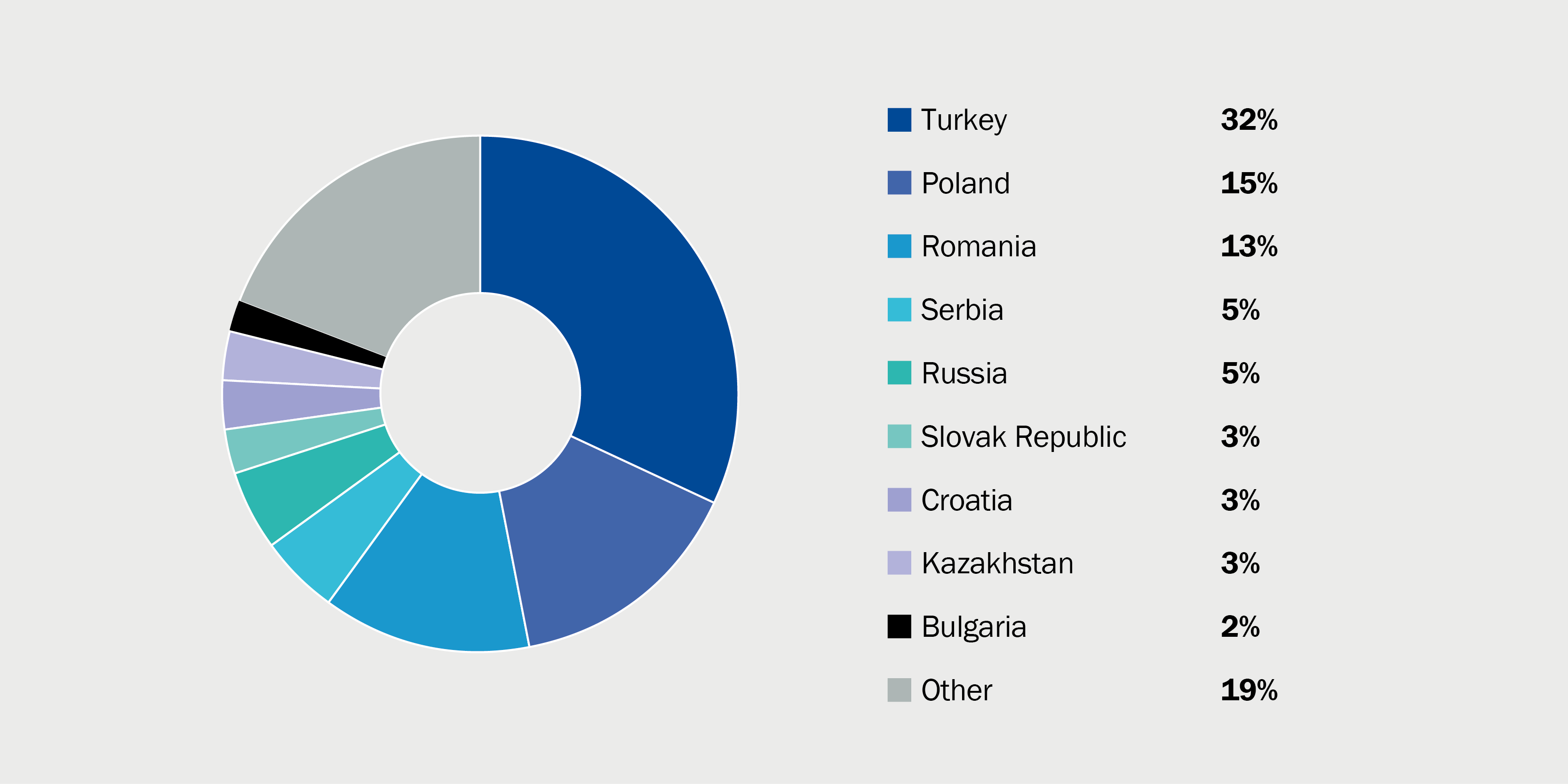

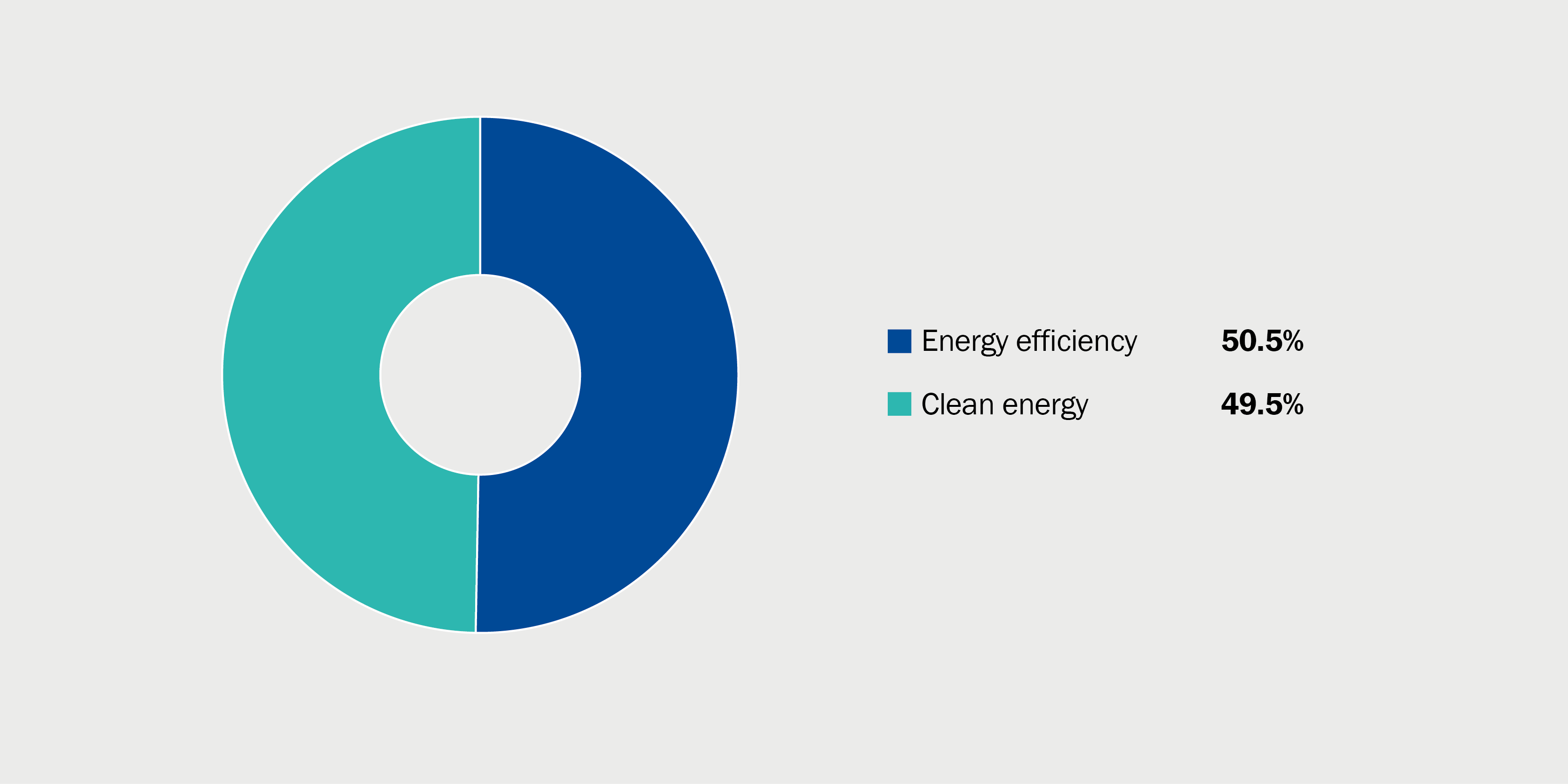

Chart 3: Green Project Portfolio sector split

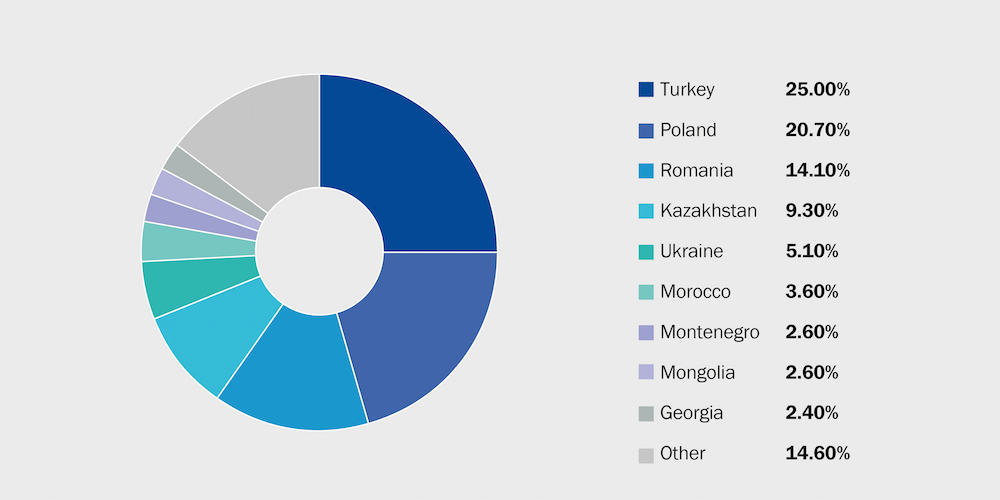

Chart 4: ‘Green Project Portfolio country split

The Green Project Portfolio comprises investments in two main areas:

1. Energy efficiency and renewable energy

The EBRD region has substantial potential for cost-effective improvements in energy efficiency and for the expansion of renewable energy production. The EBRD also provides credit lines to local financial institutions that are seeking to develop sustainable energy financing as part of their business. The Bank provides these credit lines for two key areas: energy efficiency and small-scale renewable energy. Local financial institutions on-lend the funds they have received from the EBRD to their clients, which include SMEs, corporate and residential borrowers, and renewable energy project developers.

2. Environmental infrastructure

The EBRD supports public- and private-sector operators in the delivery of essential urban municipal services at national and local municipal levels. Projects include water and wastewater services, public transport, solid-waste management and district heating.

The EBRD supports improved water efficiency by financing municipal water infrastructure projects, including investments in demand-side water efficiency. We also help corporate clients optimise water management through improved operational efficiency, product design and sustainable manufacturing techniques.

The Bank aims to identify bankable projects that help companies reduce their resource inputs and capture value from their waste. We also help companies find opportunities to reuse or recycle their unavoidable waste generation.

Our sustainability goals within the public transport sector include increasing walking, cycling and public transportation usage, increasing the energy efficiency of urban transport systems and introducing the use of sustainable renewable energy for urban public transport. We also support municipalities in reducing congestion by financing active traffic management systems.

Examples of projects

These are the types of projects that comprise EBRD’s Green Project Portfolio:

- renewable energy projects, such as photovoltaic installations, installation of wind turbines, construction of mini-hydro cascades, and geothermal and biomass facilities

- the rehabilitation of transmission/distribution facilities to reduce total greenhouse gas (GHG) emissions

- the modernisation of industrial installations to reduce total GHG emissions

- new technologies that result in significant reductions in total GHG emissions, such as smart distribution networks

- greater efficiency in mass transportation, such as investment in fuel-efficiency (fleet replacement) or more energy-efficient infrastructure

- methane capture on waste landfills and wastewater treatment plants

- the rehabilitation of municipal water/wastewater infrastructure to improve drinking water quality and wastewater treatment and to reduce water consumption and wastewater discharges

- improvements to solid waste management (minimisation, collection, recovery, treatment, recycling, storage and disposal)

- energy efficiency investments in existing buildings (insulation, lighting, heating/cooling systems)

- investments to improve efficiency of industrial water use

- sustainable and stress-resilient agriculture, including investments in water-efficient irrigation

- sustainable forest management, reforestation, watershed management, and the prevention of deforestation and soil erosion.

The Green Project Portfolio (GPP) selection criteria and procedure

The GPP is compiled using objective and transparent criteria. These are based on strict exclusion and inclusion principles (see below). These criteria are reviewed on a regular basis to ensure they remain consistent with investor and market requirements for green investments.

A key criterion in the framework ensures that only projects in which 90 per cent or more of the proceeds are directed to environmental purposes are eligible. The framework allows us to refinance existing projects, as well as finance new commitments that meet the eligibility criteria.

There are also various exclusion criteria – we exclude, for example, fossil fuel production/regeneration/fuel switching, projects funded via equity, or projects that are credit impaired. The process is a combination of automated and manual steps, with every project checked and signed off to ensure compliance with GPP eligibility and exclusion criteria. We review the GPP projects quarterly to ascertain whether they are consistent with the criteria established for the GPP.

General Bank and GPP exclusion criteria

Projects involving the following activities are not eligible for funding by the Bank:

- activities listed on the Exclusion List in Appendix 1 of the EBRD’s Environmental and Social Policy

- nuclear energy generation

- hard liquor production, defence-related activities, the tobacco production industry and gambling facilities.

In addition, projects involving the following activities are not eligible for inclusion in the GPP:

- activities listed on the Exclusion List in Appendix 2 of the EBRD’s Environmental and Social Policy

- the construction of new large hydropower installations (as defined by the International Commission on Large Dams, ICOLD)

- biofuel production (pending the adoption of internationally recognised sustainability criteria)

- fossil fuel production and projects with significant consumption of fossil fuels (coal, heating oil, oil shale)

- projects requiring a derogation from the Environmental and Social Policy for not being able to meet the Bank’s Environmental and Social Performance Requirements within the term of the EBRD transaction.

Use of proceeds

The EBRD’s Legal and Treasury teams have prepared the use-of-proceeds language for bond documentation, and these are reviewed and revised together with the eligibility criteria regularly. The proceeds from all of the EBRD’s environmental sustainability bonds are directed towards the Bank’s GPP as provided in the relevant bond documentation. The EBRD also seeks to ensure that the bond proceeds can be directed in full to its GPP by limiting the total amount of environmental sustainability bonds outstanding to 70 per cent of the GPP.

The net proceeds of the EBRD’s environmental sustainability bonds are tracked on a euro equivalent basis and, in the unlikely event that the issued bond amount exceeds the value of the GPP, the excess funds will be invested separately in money market instruments specified in the terms of the bonds until they can be allocated to projects in the GPP.

Tracking the results of GPP projects

We monitor and evaluate the progress and results of all EBRD-financed projects (including the GPP) and compare these with the benefits that were envisaged at the loan approval stage.

Regardless of whether they are subsequently allocated to the GPP, all of the projects we finance are subject to due diligence before approval to assess their compliance with our Environmental and Social Policy and Performance Requirements, and in order to draw up any action plans that may be necessary. Projects are monitored over the lifetime of the Bank’s investment through self-reporting by clients and, where appropriate, site visits by our specialists and consultants. More complex projects may also involve additional mechanisms such as regular reports from independent monitoring consultants or staged disbursements dependent on the attainment of action plan milestones.

Further details on this aspect of portfolio monitoring in 2015 are provided in the Assurance section. Project-specific information (including Environmental and Social Assessment information) is also publicly disclosed, in accordance with our Public Information Policy. Browse our projects by country, sector and year and our Environmental and Social Impact Assessments.

Projects that we finance under our Sustainable Resource Initiative (SRI) are subject to additional detailed assessments during the development and approval stage, including determination of their potential for energy savings, renewable energy and CO2 emission reductions. This information is publicly reported in a number of ways, including individual project summary documents, the EBRD’s Annual Report and the annual Joint MDB Report on Climate Finance.

These processes extend to the implementation stage of SRI projects, allowing the Bank to monitor and validate the energy savings, renewable energy output and CO2 emission reductions that are actually achieved. Our monitoring, reporting and verification systems for the SRI are constantly being developed. In 2014 we started rolling out a comprehensive programme of enhancements (see the Project monitoring section) and 2015 saw us maintain our drive for continuous improvement.

We follow similar practices for our investments in other sectors, in line with the progress measurement and monitoring commitments set out in our relevant sector strategies. Physical indicators are tracked and disclosed on a project-by-project basis. Such indicators can include public transport usage and the number of people benefiting from water and wastewater projects.

Our independent Evaluation department assesses the performance of our completed projects and programmes against the relevant project objectives and publishes a summary of project outcomes in the EBRD’s Annual Report.

Further information on the evaluation of our projects is available here.

Read more about our socially responsible investments and how we evaluate our work.

Environmental impacts of the renewable energy and energy efficiency projects in the GPP

Clean (or renewable) energy (RE) and energy efficiency (EE) projects account for 73 per cent of the GPP. In our impact reporting we have only included EE and RE projects from 2011 to 2015 to ensure consistency in the GHG assessment methodology. The projects assessed are expected to have achieved a GHG reduction of 7.4 million tonnes of CO2 equivalent (CO2e) each year. Three million CO2e of savings came from projects that used financial intermediaries (depository banks, leasing companies and non-bank financial institutions) and 4.3 million CO2e of savings came from direct investment projects. The EBRD’s portion of funding for the projects with intermediaries amounted to 86 per cent of the total project value, and the corresponding share of funding for direct finance projects amounted to 38 per cent. Please note that because of the criteria applied to the GPP, not all of the EBRD’s clean energy and energy efficiency investments are included. Investment amounts and CO2 savings for the GPP are consequently lower than those for the EBRD’s overall investments in these sectors.

Chart 5: Breakdown of million tonnes CO2 reduction for clean energy and energy efficiency

Chart 6: Breakdown of CO2 reduction by country

Environmental impacts of the water, waste and environmental infrastructure projects in the GPP

Municipal and environmental infrastructure projects, which include water, waste and public transport projects, account for 26.7 per cent of the GPP. A selection of 31 GPP projects from 2014 and 2015 were included in impact measures to ensure consistency in the assessment methodology. These 31 investments are expected to benefit a total of 9.1 million people in the EBRD region by providing them with improved water services, district heating and solid waste facilities. EBRD provided approximately 42% of total financing for these projects.

Note that because of the criteria applied to the GPP, not all of the EBRD’s water, waste and public transport investments are included. Investment amounts and project benefits for the GPP are consequently lower than those for the EBRD’s overall investments in these sectors. The EBRD financed a total of 86 projects in this sector in 2014 and 2015 that benefited 13.7 million people.

The tables below show the numbers of people benefiting from the water, wastewater and environmental infrastructure projects in the GPP:

| Total population benefitting from improved solid waste management services | 4,875,000 |

| Total population benefitting from improved access to tap water | 2,576,143 |

| Total population benefitting from improved access to wastewater services | 1,342,700 |

| Total population benefitting from improved district heating | 315,620 |

| Total | 9,109,463 |

| Country | Total population benefiting |

|---|---|

| JORDAN | 3,288,100 |

| ARMENIA | 1,315,000 |

| ROMANIA | 1,178,443 |

| KAZAKHSTAN | 825,500 |

| MOROCCO | 480,000 |

| EGYPT | 470,000 |

| TUNISIA | 400,000 |

| SERBIA | 386,000 |

| BOSNIA AND HERZEGOVINA | 263,070 |

| MOLDOVA | 190,000 |

| UKRAINE | 171,200 |

| TAJIKISTAN | 60,000 |

| CROATIA | 41,950 |

| KYRGYZ REPUBLIC | 40,200 |

| CROATIA | 41,950 |

| Total | 9,109,463 |

For interpretation of the above, please note the following: the indicators are tracked on a project-level basis and have not been pro-rated for the portion of the EBRD’s contribution. EBRD’s GHG Methodology and Climate Related Definitions and Metrics are available here. The scope of the expected impact is based on ex ante estimates at the time of project appraisal and mostly focus on direct project effects.

To read the full disclaimer for the indicators supplied in this section of the Sustainability Report, please see our Disclaimer section below.

DISCLAIMER

Impact indicators are typically based on a number of assumptions. While technical experts aim to use sound and conservative assumptions, based on the information available at the time, the actual environmental impact of the projects may diverge from initial projections.

Caution should be taken in comparing projects, sectors or whole portfolios because baselines (and base years) and calculation methods may vary.

Projects will have a wider range of impacts than are captured by the indicators presented in this report. While the EBRD makes efforts to improve the consistency and availability of reported metrics over time, projects cover a wide range of sectors and sub-sectors making complete harmonisation of reporting metrics challenging.

DEROGATIONS

Some projects in which we invest are unable to comply fully with all of the requirements of the Environmental and Social Policy. The EBRD Board approved derogations from the policy for five projects signed in 2015. The specific derogations for these projects were agreed where affordability or operational constraints made full compliance unachievable but the overall environmental, social and economic benefits of the projects were sufficient to justify our investment. With the exception of the agreed derogations, these projects will meet our policy and performance requirements.

Board-approved derogations for new projects in 2015

| Project | Derogation | Country | Sector |

|---|---|---|---|

| Tokmok Water Sub-project | Project will not fully comply with EU standards for water supply and wastewater discharge due to affordability constraints | Kyrgyz Republic | Municipal and environmental infrastructure |

| Batken Water Sub-project | Project will not fully comply with EU standards for wastewater discharge due to affordability constraints | Kyrgyz Republic | Municipal and environmental infrastructure |

| Khorog Solid Waste Project | Project will not fully comply with EU standards for landfills due to affordability constraints | Tajikistan | Municipal and environmental infrastructure |

| Kvermo Kartli Solid Waste Project | Project will not fully comply with EU standards for waste recovery and recycling due to affordability constraints | Georgia | Municipal and environmental infrastructure |

| Lviv Wastewater Biogas | Project will not fully comply with EU standards for wastewater discharge due to affordability constraints | Ukraine | Municipal and environmental infrastructure |

FINANCIAL INTERMEDIARIES

Our environmental and social requirements for financial intermediary (FI) projects are set out in Performance Requirement 9 of our Environmental and Social Policy (ESP). They focus on ensuring that banks, private equity funds and other financial institutions receiving our financing have appropriate environmental and social risk management systems in place.

Training and capacity building

Our environmental and social (E&S) e-learning programme for FIs was launched in 2013 and had over 1,000 users at the end of 2015.

The course provides FIs with a strong understanding of relevant environmental, social and health and safety issues, the risks these can present to financial institutions, and our recommended policies and procedures for managing these risks. The e-learning course is available free of charge. For further information, visit http://ebrd.coastlinesolutions.com

In August we signed Framework Agreements with two international environmental consulting firms to deliver capacity-building training workshops to our partner FIs over the next two years.

Webinar

In December 2015 the bank hosted a webinar on Environmental and Social Policy Development Best Practice for Financial Institutions. The session provided support to financial institutions in establishing an E&S policy that aligns with best practice. The audience included those responsible for E&S policy and E&S management systems within a financial intermediary as well as professionals involved in compliance, internal audit, sustainability, corporate responsibility, human resources, communications or senior management. Further webinars on E&S policy as well as on Environmental and Social Management Systems (ESMS) implementation will be held in early 2016.

Financial Intermediary Sustainability Index

In November 2015 we launched the Russian language version of the EBRD Financial Intermediary Sustainability Index (SI). The SI was designed to help our partner financial institutions understand how they are responding to sustainability issues and the extent to which they are implementing a systematic approach to managing them.

The Index will allow FIs to periodically self-assess and potentially compare their progress in implementing effective arrangements for sustainability risk-management. The SI will also allow us to compare FIs in this area over time and to monitor progress at the portfolio level. Over 250 partner FIs are using the SI.

International initiatives

We were represented on panel discussions relating to Responsible Investors in Poland in February 2015 and at the World Bank-led roundtable to discuss managing environmental and social risks in private equity funds held during the International Association for Impact Assessment conference in Florence, Italy, in April.

During October the EBRD participated in the United Nations Environment Programme for Financial Institutions (UNEPFI) Annual General Meeting which was held in Paris.

In 2015 the EBRD participated in two awareness-raising events held at the Bogazici University in Istanbul on sustainability initiatives within both the financial and non-financial sectors in Turkey.

We also continued to play an active role in meetings and initiatives with other multilateral financial institutions and European development finance institutions, sharing experiences in implementing good practice and the environmental and social aspects of investing in FIs.

HEALTH AND SAFETY

All EBRD-financed projects are held to high occupational health and safety (OHS) standards as part of the Bank’s continued due diligence. We monitor and respond to trends across the Bank’s portfolio and take prompt and effective action where necessary.

Our clients are required to notify the EBRD of any serious incidents and fatalities. In 2015, we received reports of serious incidents from 21 clients, which sadly resulted in 56 (96 in 2014 and 102 in 2013) fatalities.

The main causes of fatalities were: electrocutions (16 reported); being caught or struck by an object/moving vehicle (15 reported); and vehicle collisions (eight reported).

Seen in context, the EBRD’s portfolio collectively involves tens of thousands of people, be they employees or contractors, working across some 1,500 projects at any one time, to say nothing of the millions of customers and end-users our projects benefit.

We did a lot of work in 2014 to improve our processes for risk assessment and monitoring, and the fatalities reported in 2015 were almost half what they were in 2014. However, any loss of life is always a sobering reminder of the challenges that businesses and communities face in the EBRD region, and strengthens our commitment to build on the improvements we’ve made in monitoring the OHS aspect of our projects.

We continue to work with businesses and communities across the EBRD region to minimise risks associated with our projects, to improve safety standards and raise awareness.

For example, in Moldova, in partnership with the UK companies Gap Hire Solutions and the Kier Group, and The Institution of Occupational Safety and Health (IOSH), we also helped to provide cable location devices (CATs) free of charge to construction companies, as well as training on their safe and correct use. This initiative aimed to introduce best occupational safety practices to help manage the risks of electrical hazards when digging during urban infrastructure works.

In addition, we have mobilised nearly €600,000 from the EBRD Shareholder Special Fund for the occupational health and safety framework, which includes appraisals and capacity-building for clients in higher-risk sectors.

PROJECT COMPLAINT MECHANISM

The Project Complaint Mechanism (PCM) is the EBRD’s accountability mechanism for assessing and reviewing complaints about projects the Bank finances. It provides a structured method for individuals and local groups who may be directly or adversely affected by an EBRD project, as well as civil society organisations, to raise grievances or complaints with the Bank independently from our banking operations.

The PCM has two functions. The first is to review complaints from parties concerned that the Bank has failed to adhere to applicable policies in a particular project, which is conducted through the PCM’s Compliance Review procedure. The second is to assist members of the affected community in addressing their grievances with the project sponsor, which is carried out through the PCM’s Problem-solving Initiative. Affected parties can have their concerns addressed via one or both of these functions.

In 2015 the PCM registered three new complaints and continued working on different stages of the review process for 11 ongoing complaints. Five complaints were closed in 2015.

The PCM also conducted two outreach workshops with civil society organisations in Istanbul and Zagreb, in partnership with the accountability mechanisms of other international financial institutions.

A new PCM Officer started a five-year term at the EBRD in June 2015, and two experts were added to the panel this year, bringing the total to seven experts.

Details of all complaints and reports, together with PCM Annual Reports, are available on the PCM website.